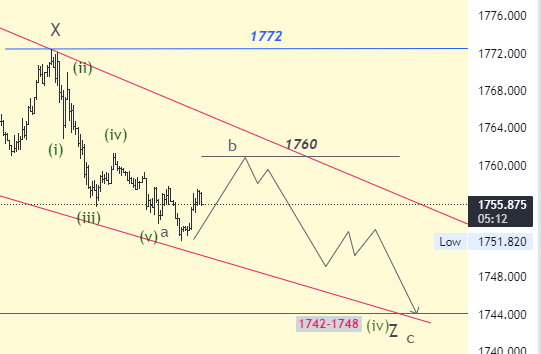

As we discussed, Gold Correctio WXYXZ Pattern analysis on week end 19th Aug 2022

First "a" wave of "Z" wave is completed as five waves and "b" wave as the inverted flat is unfolding. We may see the final "c" wave after the completion of the "b" wave.

"b" wave may finish between 1760-1770 and the final "c" wave between 1742-1750.

If the price moves above 1772 then we may consider Low 1751 as the bottom and up rally started and we will wait for Buy in correction.

If the price break 1740 then this analysis is nullified and the downtrend intact.

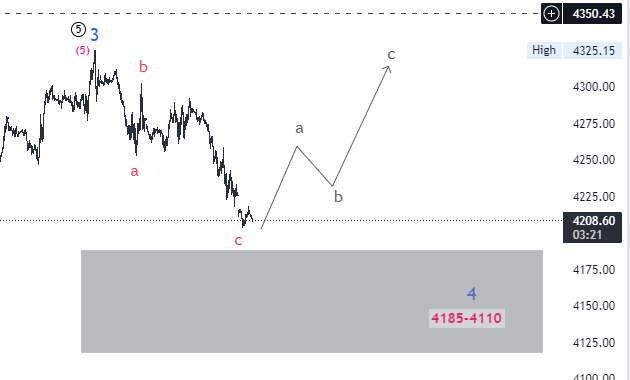

Now Let's fresh analysis again,

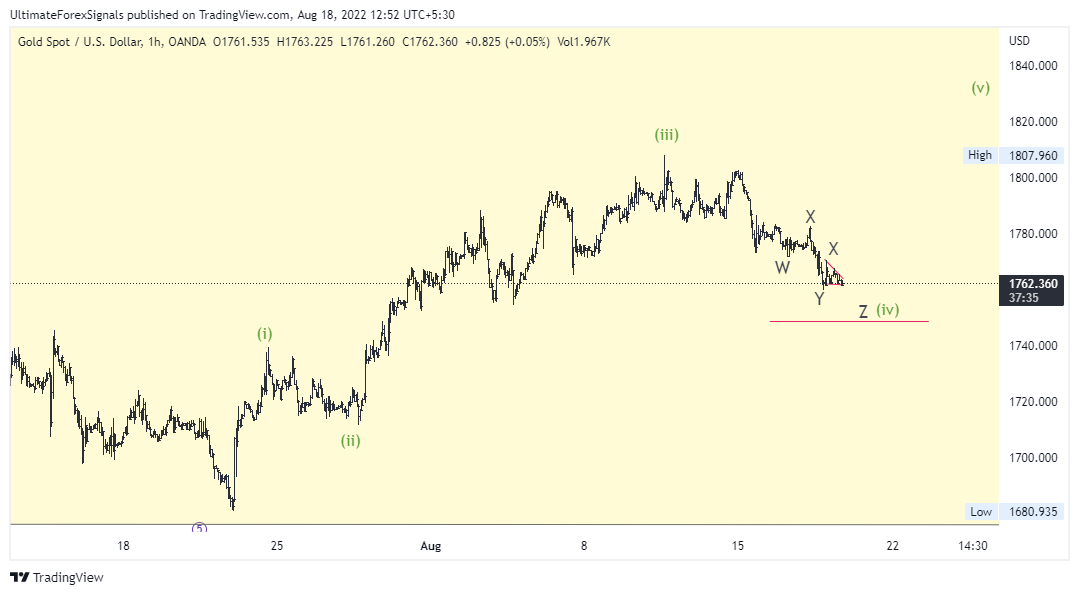

Gold 1H Chart :

I have labeled 1681 to 1803 as five waves completed as I,II,III,IV and V.As alternation, II wave was complex and IV was sharp correction gave confidence to labeling as given in chart. An interesting thing was seen wave V failed fifth wave completed at 1803.

In general, after failed fifth wave correction is deep and last longer as appeared from 1803 to till date 1745 in just 5 days.

ABC (5-3-5) Correction :

After five impulses, correction of the entire five impulses has to be seen. This correction is shown as ABC Zig-Zag (5-3-5) in which A wave as 12345 is almost completed.

Let's Forecast "B" wave (3 waves as abc) for the coming week:

B wave correction will have also 3 waves as abc.Now, abc will be unfolding which type of correction? Clue of this skill gives a successful edge in trading.

Three types of corrections,

1.Flat (Simple & Inverted) (3-3-5)

2.Zig-Zag (5-3-5)

3.Triangle (3-3-3-3-3)

The principle of alternation works in most situations. As we have seen A wave as five wave , we expect B wave as flat (Simple or Inverted).

If it will be a Simple flat then price will again see near prior low 1745 as sub-wave"b" after sub-wave "a" above 1750.

If it will be an Inverted flat as mentioned in the chart then we may see one more Low between 1735-1742 as sub-wave"b"

sub-wave "c" may see between 1767-1783 and will discuss after the completion of sub-wave b.